there is absolutely nothing in florida that makes it worth living there

Florida is like an old used car: cheap upfront costs but expensive maintenance costs.

Florida is like an old used car: cheap up front costs for a dangerous vehicle that you know will eventually fall apart but you act surprised when you lose a ball joint in your front suspension on the highway while doing 120 kph because you ignored your mechanic for the fourth time this year. The look on your face as your car crosses the median and you’re about to impact a cement truck.

They do have a first-class spaceport… Watching a rocket takeoff from there would be the only reason I ever go to Florida.

i went to see a launch in early 00’s. it is interesting, maybe worth a trip, but not worth moving there

Alligators tell me otherwise. In fact, they tell me they look forward to having it back to themselves soon.

I lived in Louisiana. Although surely they can and periodically do cause harm they really want nothing to do with you. Just don’t screw with one and you’re fine.

Disney world is pretty nice. Maybe we could move it out lol

Disney is the shittiest reason to come to FL.

As a California I concur, Anaheim is a hellhole. Mind you my sense of entertainment is watching Germans burn and get heat stroke out in the Mojave, its extra funny cause I am usually paler than them.

I’m amazed Disney hasn’t already made plans to move out of Florida.

Florida needs to stop rebuilding in the barrier islands. It’s unfortunate for the people that live there, but this is going to keep happening over and over again.

Just plant mangroves and let them do their job of protecting the mainland.

Stop building on the coasts in general. leave them as natural barriers and wonders, rather than having a 800 foot tall hotel 3 feet from the seawater.

One 800 foot hotel is way better than the 10 80 foot hotels that usually get built.

This is why insurance should be nationalized as part of your taxes.

Anyone thats not a brainwashed rightwing lunatic would see that paying 100-300 dollars a year on taxes would be a hell of a lot better than 100+ dollars a month just to buy a CEO a golden parachute and another yacht

But as long as right wing lunatics are out there literally hunting aid workers and evaluators, its never gonna happen… because they want misery, pain, and destruction. its why Project 2025 wants to get rid of all of it.

I agree with nationalized healthcare insurance, but I don’t know if I agree with using taxes to fund an underwriting account for houses in Florida that are guaranteed to get destroyed year after year.

Hurricanes are not getting smaller. Continuing to rebuild in Florida seems like building in the shadow of a smoking volcano.

Insert Bugs Bunny sawing off Florida from the mainland

Go a bit deeper. Everywhere is fucked. Nowhere will be insurable soon. Now what? Maybe we should get serious about degrowth and climate change instead

What if we threaten meteorologists and FEMA instead? /s

Insurance can still payout and people can still be made whole for property that’s deemed uninhabitable. You do not have to “continue to rebuild in Florida”, but you can make sure people’s lives aren’t completely ruined as a result of natural disasters.

I think a similar strategy is used with Federal flood insurance. When properties are destroyed multiple times I think they offer a buyout.

So just stop helping people in florida specifically?

Or we just gonna go full republican hatemonger and tell everyine from California earthquakes, To Midwestern Tornados, to Northern Blizzards, and more, to just get bent and that they should have thought to live somewhere without regular disasters? That they deserve what happens to them for “choosing” to live there?

My insurance company has determined that my house would cost about $450k to completely rebuild in the event of a total loss. Thankfully in the Northeast the risk of my house being destroyed is low, so they charge me $1,100 annually. Even with a few houses in my area being destroyed by fire, flood, or extreme weather, they still make enough to build up their reserves, pay their employees, and kick back some to the investors.

How much would that company need to charge in Florida so they could still pay to fix the houses and pay everybody that works for them? Definitely not $1,100/yr because replacing just a single broken window costs $1,100.

Now think about if the Federal government began covering Florida. They would have the same issue as private insurers - there is no amount they can charge that will not deplete their funds faster than they take in premiums.

Definitely not $1,100/yr because replacing just a single broken window costs $1,100.

Gee, if only there was some kind of pooled money that people could pay into so they could cover such things. So people could pay small, affordable amounts to get taken care of and helped if tragedy strikes them.

You know, like spreading the risk out, like some kind of…insurance?

And besides, Sounds like you specifically just want to hang people out to dry in Florida for the sin of living in Florida since you conveniently neglected/ignored the biggest part of my post about where does the line get cut for telling people they don’t matter because where they live.

And of course, I doubt you’d be so “Well I dont deserve help cause its my choice to live here” when disaster strikes where you live, or your mother, or family live. I bet you’d be full of righteous fury and indignation if anyone dared to say that to you.

But its different when it personally affects you, right?

If everyone in the US paid to rebuild Florida over and over that’s not insurance that’s practically a subsidy. Do you think it’s fair for someone in Illinois who has no benefit of Florida beach front views pay the price to fix a snowbirds vacation home over and over?

Florida is different because the risk is perpetually high and living there is a choice. It’s fine for people to choose that risk, but I would expect sky high coverage.

Do you think it’s fair for someone in Illinois who has no benefit of Florida beach front views pay the price to fix a snowbirds vacation home over and over?

You’re right. Its not fair for people to have lower insurance costs and a single unified pool.

It obviously makes much more sense to pay 3x the amount to a national, private insurance provder, have them take most of that for CEO and executive pay/bonuses/benefits, and then close offices and cancel policies in florida because they cant “afford” it.

Fuck off with your right wing bullshit already. You aint masking half as well as you think you are with this project 2025 shit.

I’m definitely not a Republican. Sorry my take seems to have struck a chord with you, but I don’t think what I said was illogical.

So, in the post you’re replying to, it’s laid out how insurance wouldn’t work, and your reply is “Have you considered insurance?”

Even making it a state plan would work better in Florida than what we currently have. They let private insurers cherry pick the less risky houses, and cover whoever is left with the state plan. Then those private for profit insurers take the premiums, pay big bonuses to themselves, dissolve the company and leave, rinse and repeat. It’s a scam.

The cherry picking is usually a compromise to keep the companies operating in the state at all. If the state says a company must offer coverage for all perils for the entire state or leave entirely, it doesn’t take an underwriter to know Florida is a bad bet. There are similar carve outs for windstorm coverage in other gulf coast states, and I think for wildfire coverage on the west coast.

Edit: I couldn’t find anything about a single peril state plan for California, but this article describes some of the recent insurance issues in the state: https://apnews.com/article/california-home-insurance-wildfire-risk-premiums-047bdfa514ce93dac83c82735a15554a

The “California Earthquake Authority” provides the earthquake insurance for California: https://www.earthquakeauthority.com/about-cea/frequently-asked-questions

I had not realized before reading that now that it’s actually not state-funded. It sounds like it’s a pool of all insurers together.

Florida is talking about a state windstorm pool (risk pooling, not gambling pool) like the national flood insurance. I guess that would be the compromise, but the insurance industry here really is plagued with fraud. The companies keep folding then coming back, I can only assume they are lining the pockets of the legislature with our money.

In the years I’ve owned a house (about 30) I have paid them enough that if I’d banked it instead at a reasonable rate of return I could buy another house. But have made no claims. So they are charging like every house will be knocked down once every 30 years, I guess, but again, my previous house and that whole neighborhood from 1925 is still standing.

Believe me, I’m with you. But a complication to this is that insurance companies employ millions of people. Nationalizing them needs to take all those livelihoods into account, and would be nearly impossible without going full on socialist (which I am completely for, I don’t think it’s feasible to continue a capitalist system when it is clearly breaking down and killing the planet while doing so.)

Flood insurance is nationally subsidized. People use it to afford their marina properties in Washington state.

The down vote shows you hit a nerve…

Why should taxpayers subsidize someone’s dumb decision to buy a Florida beach house?

“Why should I have to pay for YOUR kids to go to school?”

“Why should I pay for social safety nets when I’m well off?”

“Why should I pay for roads when I don’t drive?”

Because there will come a day where you may need the help, and it wont be there cause your pigheaded myopia, and then you’ll cry and cry about the unfairness of it all and maybe, just maybe, if you have a functioning neuron in that brain of yours, that maybe the fraction of a cent of yours that actually goes to help people isnt such a bad thing afterall

None of your examples involve encouraging people to make stupid decisions like building a house that’s almost guaranteed to be destroyed within a few years.

Unbounded risk-taking such as insuring people building houses in risky locations will lead to bankrupting the country.

If insurance is going to cover it, then there needs to be stipulations on the home owner to reduce the risk - for example, building the home out of steel and concrete, raising the structure high enough so that floods and storm surges cannot reach indoors, etc.

Unbounded risk-taking such as insuring people building houses in risky locations will lead to bankrupting the country.

Bullshit.

Its a drop of piss in the ocean compared to all the ridiculous shit America wastes money on every single goddamn day.

Oh the hell it will.

We could have a functional colony on the moon and mars if NASA got a quarter of the military budget.

Maybe, just maybe, we stop spending billions to kill brown people for no good reason, and spend a tiny fucking fraction of that to make our own part of the world Less of a shithole, instead of more

The first step in not living in a shithole is to not build a house in a shithole, e.g. swampy Florida.

Are you stupid?

The vast majority of people living in Florida, didn’t build a fucking house there.

Most of the people living there, can’t afford a house.

Like yeah, fuck the vacationers, they’re probably the reason we’re reading an article about house insurance. But the people who were born there with all their family and friends there, what the fuck are they supposed to do

“Why should I pay for social safety nets when I’m well off?”

Self preservation

Call it Guillotine insurance

Edit: I see now the comment I replied to is about subsidizing losses, not about having a state run insurance program.

If the premiums are risk based, why not not? Ideally there would also be a buyback program for homes deemed to be uninhabitable due to climate risk. Maybe something like the state will buy the house at 80% of the value used for property taxes, up to a certain maximum (fixed dollar amount? Percentage over the county/state median?) This buyback program could be used when the premiums become unaffordable.

You know, not everyone living in Florida has a beachfront vacation home, right?

Not everyone living there chose to live there either.

Did you know people can be born places? With family? That aren’t rich?

Until you get hit by a natural disaster, then it’s different?

Of course you need a evaluation if the damage should be replaced and how the owner could have avoided some damages… that is how insurances work.

Don’t build zou house close to a wildfire spot. Don’t buy property in a Hurricane path…

Thing is: This shit will happen everywhere anytime.

Welcome to climate change. This is just the tip of the iceberg: things are just going to continue getting worse and worse each and every year.

Anyone that rebuilds in place after their whole house is destroyed is nuts… if you get insurance payout… this is your chance to move.

And we should demand that insurers stop paying for shit that we could predict. They should fill Florida with recyclable stuff as a big landfill and with rocks, then just drop a few invasive tree species, elephants, lions etc and put a big fence around the place. Then each year we would only need to rescue animals and not people. Rescuing animals is far more inconsequential. Nobody cares if the animals are homeless, but everyone hates homeless people.

Insurers have this in their pricing. Which is why you see some withdrawing completely, some offer stripped insurance that won’t cover this and the ones that will still offer hurricane coverage will do so at prices that will cover their exposure… and that will be prohibitively expensive for most.

Insurance exists to pay out. We don’t need to give them more reasons to deny people. Making laws to prevent rebuilding is the real answer.

I’m being sarcastic ofcourse. Let me get my beer out of the fridge…who put this elephant 🐘 in here! I’ve told you guys to never put an elephant in the fridge when there’s already a giraffe 🦒 in there! LOL.

Florida was interesting to briefly visit. But at this cost, we might as well give it back to nature.

I think we want the opposite of that. We want insurers to definitely pay out if they sold policies. We don’t want them to collect premiums and then find shady ways to deny payment. If they decide to leave the market entirely, good for them, but as long as they’re selling, we should insist that they pony up the payments.

Agreed. If they signed a policy they should pay for the loss. It should be an actual risk that we are paying them to ensure won’t happen…so if it does, then they should pay for it. And if it doesn’t make sense, they should not insure you. But then it would be good to not actually require insurance for home ownership. I would love to do that in case I don’t actually care if the place gets hit by a hurricane. That incentive pushes me to design my house such that it can survive with little to no monetary loss to myself.

Insurance companies in the US have become a Ponzai scam instead of a service.

is that a meme or did you accidentally butcher the term “ponzi scheme” which is something entirely different? not saying insurances aren’t often a scam. just a different kind.

I modified it slightly to suit the situation.

Why do you not think a Ponzai scheme fits?

Because a Ponzi scheme revolves around paying past people with fresh money without using it as promised at all.

Insurances (when fraudulent) collect money but don’t pay out anyone unless forced by lawsuits. Ponzi schemes are s vers specific financial tactic.

I guess I see enough parallels to call it “close enough”, but I guess that’s a matter of perspective.

meanwhile the people taking your money and giving you nothing in return are laughing at the fact that people are spending time debating “what kind of scam” it is

It’s not a matter of perspective. You used the wrong term. No big deal, we’ve all done it, and now you know.

I don’t understand the pun you are going for here

deleted by creator

Insurance companies save money by denying claims on a normal day. Paying to rebuild an entire state would jeopardize the big number going up and thus executive bonuses.

They won’t be paying claims. They’re not going to pay to rebuild a house that their models say will be knocked down again in 2-3 years by the next “storm of the century.” Insurance companies exist to extract wealth, not to help people. And they will always have more lawyers than you.

They also have all kinds of weasel options in their coverage. “Sorry, you were covered for wind, not flood” They’ll avoid paying any way they can.

But do they have more lawyers than the banks? Most of those houses are actually the bank’s houses.

If your insurance only covers 50% of the property value it is essentially useless.

This is absolutely insane.

Wait until you hear about the deductible… where I am (not earthquake country by any means) the deductible was $80k. I sad pass on that.

My in-laws learned this the hard way after a total loss fire. Their insurance covered the current value of the house, not the cost to move/replace it in a total loss scenario, so now they have a big mortgage for their new house when the old one was nearly entirely paid off

50% of a seven-figure number is still at least a six-figure number. Very useful, definitely not essentially useless. If you disagree, please give me six figures, which you apparently don’t need, so I can test the theory.

Yeah I’m sure every home destroyed was worth over a million. That’s just a straw man.

My home insurance in the UK covers the full cost of tearing down and rebuilding if the house is damaged beyond repair. As it bloody should.

That’s why you get AFLAC for the other stuff.

Ah so just purchase more insurance for the things the insurance I already pay for doesn’t cover?

Absolutely. It is also never a bad idea to have at least 6 months in expenses saved up in cash for emergencies. And another 10 thousand to keep an attorney on retainer.

I’m perfectly fine letting Florida handle Florida’s problems.

Someone should point out to most of the right wingers that FEMA is socialism

Dont worry they voted unanimously to not expand fema right before both hurricanes.

It’s only socialism when the libs get it. Otherwise it’s their god given right.

They are already hunting FEMA folks.

Yup. Let the states decide, then pay for it

Yeah, but then we get Desantis as president in 2032…

Not if he has no state left to represent.

State? by then it will be a country governed by a Christian monarchy

Not a chance.

Also, we will be lucky if there is even an election in 2032.

Are we definitely skipping the 2028 election, then?

Naw people hate that turd. Only reason folks think that is because he says the same stupid shit as Trump. But Trump is one of a kind in the crazy camp, can’t reproduce.

You’re right. There is no one “better” than trump at… whatever it is he does.

deleted by creator

I disagree. Cheato-Mussolini’s brand of fascism might be uniquely his own, but fascists are like cockroachs so there will always be another to replace Trump after he is gone.

Insurance companies: “Wait you actually expect us to provide the service you’re paying us for? That’s not how this works!”

I feel bad for the Tampa homeowner who discovered homes in their neighborhood used to be worth seven figures and are now worth low six figures.

I think we all predicted that kind of thing would happen somewhere someday, and Florida is one of those top places on the list, but even so, we should be sympathetic. You never really think this kind of thing is going to happen to you, after all. Best of luck to everyone whose homes were destroyed.

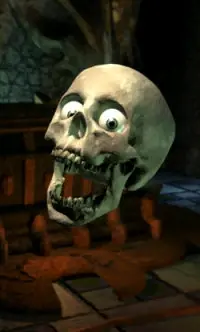

I don’t. They dropped everything and moved across the country to a place with a known problematic housing market then gave the shocked picachu face when they couldn’t get back out. Remember that they dropped $550k cash. They are going to recover.

Someone who can afford a seven figure house is part of the 1% I’m not going to feel sorry about them losing a portion of their wealth that still keeps them above 95% of people.

Uhhhh.

https://www.google.com/search?q=what+percentage+of+homes+are+over+%241+million

Apparently per Redfin 8.5% of homes in the US are 7 figures or more. We’re not talking the 1% here.

In California the median home price is almost $800,000.

I’m in a HCOL area in Washington State and regularly see 3bdrm and sometimes 2bdrm condos for over 1 million.

Not to mention sure your home is equity or net worth but most people only buy one and sell it anytime they move. Many of these people also planned on selling it / downsizing in retirement and converting it towards their retirement fund.

Remember that “afford” doesn’t mean they have a million dollars. “afford” means they saved up a down-payment and then paid interest and mortgage payments (sometimes barely scraping by) for at least 30 years. Usually many more years if they moved from smaller house or a condo to a larger house when they decided to have a family (thereby starting a new mortgage for another 30 years). Or worst case, they haven’t paid it off and now are underwater on their mortgage.

The banks are the ones making crazy money on all this.

Who could have seen this coming?

If only climate scientists had warned us 50 years ago we probably could have done something.

They have been warning us about the effects of CO2 in the atmosphere since 1896, then the people who produce the most CO2 bought the media and kept it quiet and gaslit.

If only we listened to Svante Arrhenius and acted then, we could have had a chance.

The insurance companies saw this coming. That’s why they have the clauses that exclude flood damage.

every client of the companies affected with see that cost

well yes, that’s how insurance works

Florida did this to themselves by deregulating parts of the insurance industry and making denials easier so that insurance companies would keep insuring places that are most likely to suffer from the effects of global warming and are in high-risk locations that people refuse to leave from.

Turns out Florida basically said “here, we’ll make it so you can keep taking people’s insurance payments and give them the illusion of homeowners insurance, but we will make it so you can easily and regularly deny any actual claims.”

Classic Florida! 🤣